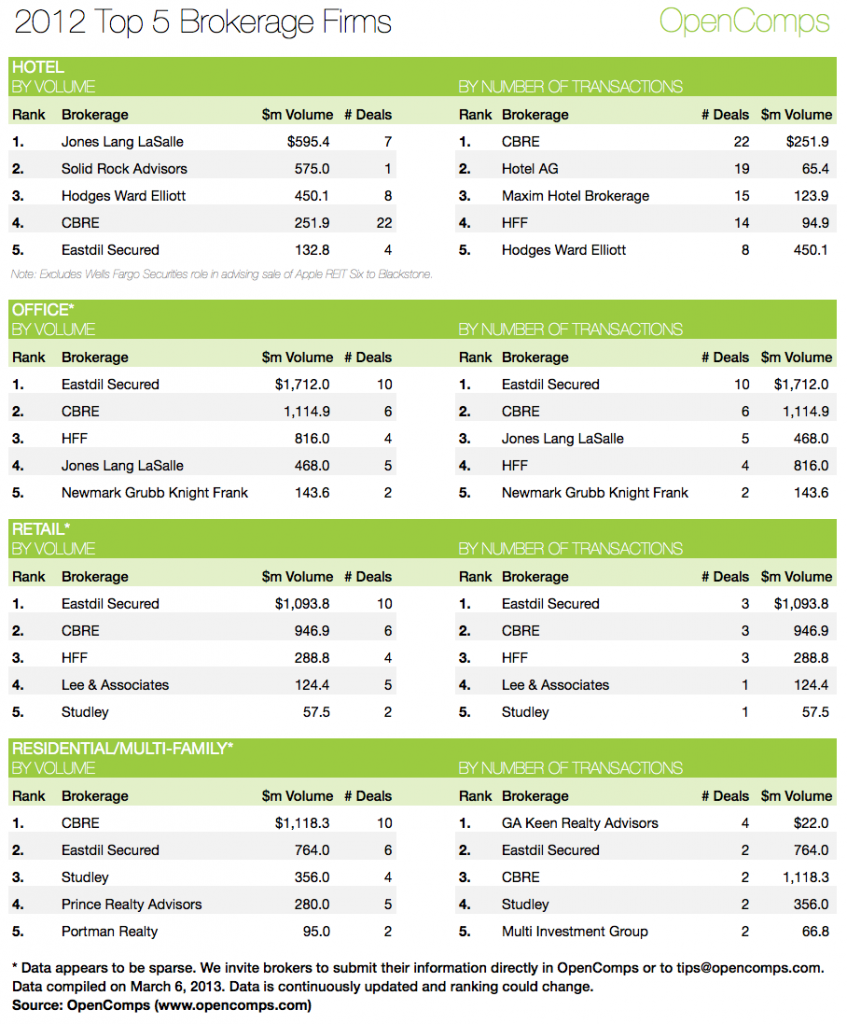

Continuing with the 2012 review, here is a snapshot of the 2012 Top 5 Brokerage Firms rankings as they stand on March 6, 2013. The data is dynamic and changes when new transactions are introduced in the dataset. For the full and most up-to-date 2012 list, you can go to the hotel, office, retail and residential rankings. Don’t forget the “Top Broker” dropdown menu to see who is the most active year-to-date (2013) or create your own custom period (the default gives you the all-time ranking).

The table reflects United States only transactions as outside of the U.S., regrettably, our database does not have many datapoints. We welcome your input. The same is true for our Office, Retail and Residential data, even in the U.S. As a broker, you’ve worked hard to put the transaction(s) together. Shouldn’t you get credit for it? Register for OpenComps for free and update the transactions you’ve worked on or give us your unrecorded transactions. If you prefer to just email us, you can do so at tips@opencomps.com. Send us your one transaction or the in-house spreadsheet if you are that productive. You deserve the credit!

Finally, the table represents top sell-side brokers. In OpenComps we also track buy-side brokers. But let’s be frank, sell-side is where the action is.