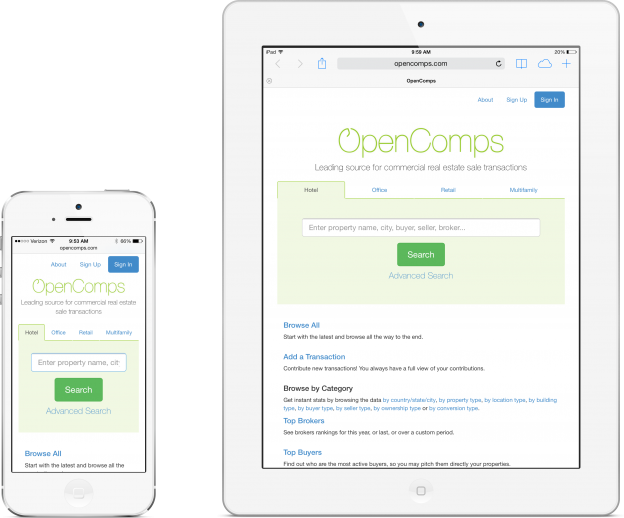

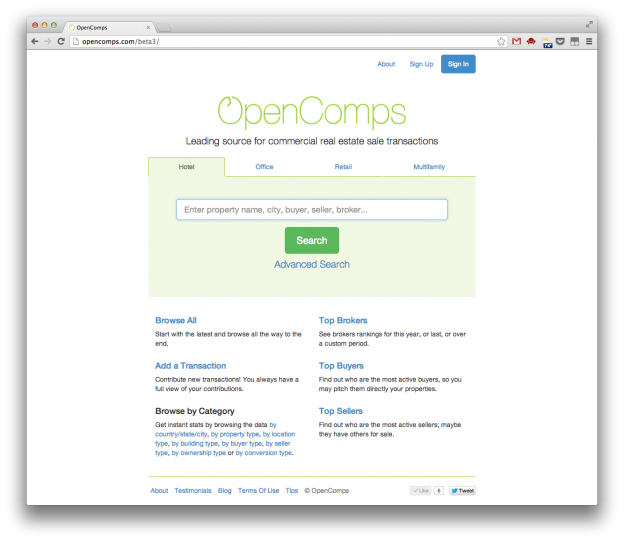

Just as fall is getting started to do a makeover to the trees outside, we are ready with our site makeover too. We worked hard on it all summer and, dare we say, we are very happy with the results. But the final judges will be you, our users…. so we would love to hear your thoughts!

Just to be clear, our makeover is just like a new suit… we may look different, but our simplicity in functionality is still there as you (hopefully, just as much as we) like it. The pockets, buttons and sleeves are still in the same place on the suit, just like our functionality is still there where you can see it and access it conveniently and expediently.